Taxes

The City of Alamo is not accepting property tax payments at the City Hall location.

Please pay your property taxes at any of the Hidalgo County Tax Offices. If you have questions regarding your tax account(s), please call any of the numbers below. You can also visit the Hidalgo County Tax Office website.

How to pay:

💻 Online at www.hidalgocountytax.org

📬 Mail to Hidalgo County Tax Office, P.O. Box 178, Edinburg, Texas 78540

👤 In person at offices or at any Lonestar Bank (original light yellow tax statement or online statement is required when paying at the bank)

☎️ For more info call (956) 318-2157

Location | Address | Phone |

Main Office Edinburg | 2804 S US Hwy 281,Edinburg, TX 78539 | 956-318-2157 |

Alamo Substation | 1429 S. Tower Rd., Alamo, Tx 78516 | 956-784-8688 |

San Juan Substation | 509 E. Earling Rd, San Juan, Tx 78589 | 956-784-8688 |

Mcallen Substation | 300 E. Hackberry Ave, McAllen Tx 78501 | 956-686-7424 |

Weslaco Substation | 1902 Joe Stevens, Weslaco, Tx 78596 | 956-973-7885 |

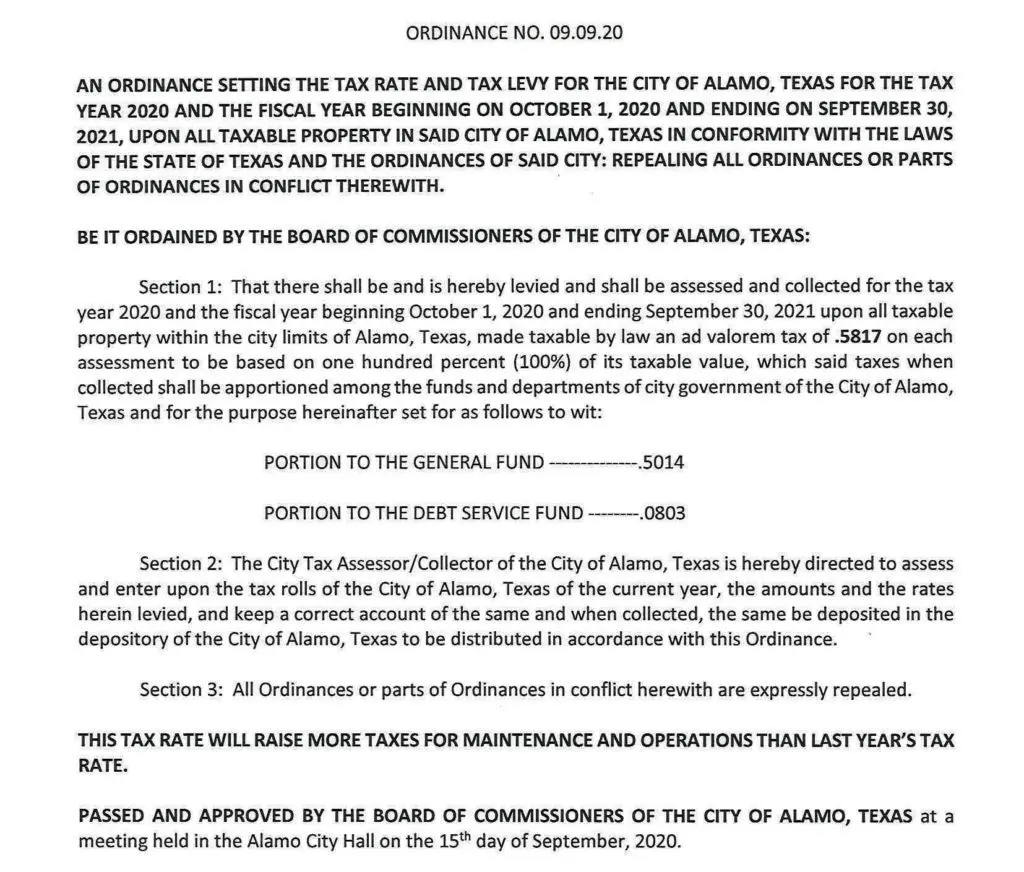

AD VALOREM TAXES

The City of Alamo assesses an ad valorem tax on all real and taxable personal property within the city limits.

The tax rate is usually adopted in September and tax bills are mailed by the Hidalgo County Tax Office. Property owners have from November 1 to January 31 of the next year to pay taxes without penalty and interest. Taxes become delinquent on February 1 and a 7% penalty and interest charge is assessed. The penalty and interest increases to 9% in March, 11% in April, 13% in May and 15% in June. On July 1st all delinquent accounts are referred to our delinquent tax attorneys for appropriate legal action and an additional 15% collection fee is charged.

POINTS OF INTEREST:

On real property (land and buildings), the current owner can be held accountable for any unpaid taxes even for years before he/she bought the property. The new owner is liable for the entire year’s tax, even if that person bought the property during the year and had the tax prorated with the seller at the time of closing.

The tax collector does not have any legal authority to forgive the penalty and interest charge on unpaid taxes. These charges are set by statue and can only be waived after approval by the governing body if an act or omission of an officer, employee, or agent of the taxing unit or the appraisal district caused the account to become delinquent.

The Hidalgo County Appraisal District is a separate local agency and is not part of the city tax office. The appraisal district decides what property is to be taxed, its appraised value and whether to grant exemptions. The appraisal district also determines the ownership of property and their address. This information is then certified through an appraisal roll and forwarded to the city tax office.

EXEMPTIONS:

The Board of Commissioners has adopted an ordinance that will essentially freeze the taxes for qualified home owners that are 65 years of age and/or are disabled.

The City of Alamo has adopted two local options. One grants a $5,000 exemption to anyone who has been certified as disabled. The other $5,000 is for residents sixty-five years of age. In order to qualify for either of these exemptions, the property must be the owner’s primary homestead. According to state law, if a property owner is both disabled and over 65 years of age, only one exemption is allowed.

The disabled veteran exemption is mandated by the State of Texas and the amount of exemption is based on the disability rating. Disability rating of not less than 10 but not more than 30 percent is a $5,000 exemption. Disability rating of more than 30 but not more than 50 percent is $7,5000. Disability rating of more than 50 but not more than 70 percent $10,000. Disability rating of more than 70 percent; or a veteran who has a disability rating of not less than 10 percent and is age 65 or older; or a disabled veteran whose disability consists of the loss or loss of use on one or more limbs, total blindness in one or both eyes or paraplegia is $12,000.

PAYMENTS:

Please pay taxes at any of the Hidalgo County Tax Offices listed above.

State law allows certain homeowners to pay their taxes over a period of time in four equal installments. Homeowner’s ages 65 or older that have applied for homestead exemptions may pay current home taxes in four installments. The homeowner must pay at least one-fourth of the taxes before the February 1 delinquency date. At the time of payment, the homeowner must indicate that he/she wishes to pay the taxes in installments. The remaining installment payments are due before April 1, June 1 and August 1. If the homeowner misses an installment payment, the tax collector will add a penalty of 12 percent and an interest charge of 1 percent for each month the payment is late. A homeowner may pay more than the amount due for the installment and the excess will be applied to the next installment. The homeowner, however, may not pay less than the installment amount due.

CHANGES ON RECORD:

Mailing address changes can be made at any Hidalgo County Tax Offices. Staff has the customer sign the authorization form that will then be forwarded to the appraisal district. Property owners do not need to contact each taxing entity.

Ownership changes must be recorded at the Hidalgo County Appraisal District, 4405 S Professional Drive, Edinburg, Texas 78540-0208. This ensures that the property owner’s information will be properly documented and that the allowable exemptions be applied for.